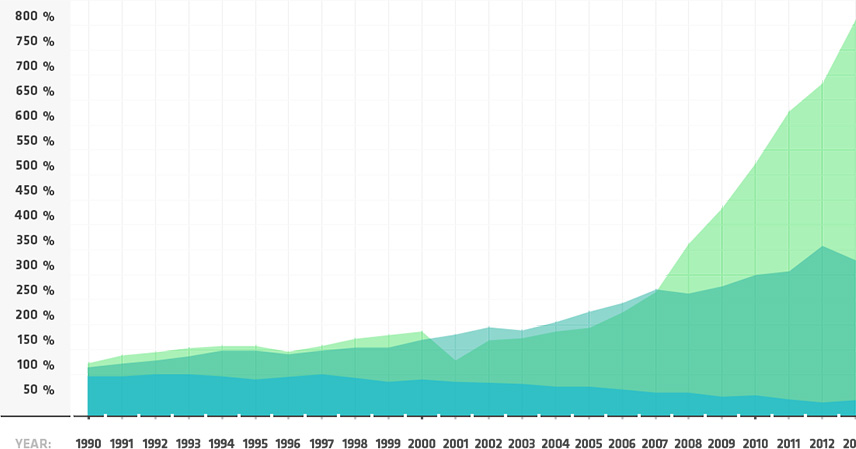

U.S. Energy Mix, indexed to 1989

U.S. Electricity Net Generation:

Excluding generation from wood, conventional hydroelectric, and hydroelectric pumped storage

Walden Green Energy is founded in 2011

Walden establishes its track record by developing, building, and operating 10MW of hydro and solar projects

Walden’s global development pipeline grows to over 500MW of hydro, wind, and solar

Walden executes its build-out strategy targeting 1000 MW of hydro, wind, solar, and bioenergy projects in development and operation by 2017

Walden develops, owns, and operates clean energy projects using proven technologies that efficiently harness local renewable resources

We capitalize on market volatility to invest in deep value opportunities around the world. We are committed to a hands-on execution approach coupled with a strict investment discipline. We believe diversification is vital to successfully capturing growth, delivering attractive returns, and creating long-term value.

We draw on our management team’s comprehensive global commodity and financial markets background, as well as a full-spectrum renewable energy track record, in order to identify exceptional investment opportunities and effectively execute our diversification strategy.

We create positive social impact by delivering cost efficient, clean power to regions with rapidly growing energy demand. We consistently strive to strike a balance between sustainability and returns.

walden’s Management Team brings its extensive expertise and experience to bear on market analysis, project and partner selection, and development execution

The Team has collaborated on numerous projects and significant deals in the commodities space over the last 10+ years

The Team has demonstrated capability to originate, develop, finance, construct, own & operate clean power projects globally, as well as excel in highly volatile markets

Prior to Walden, George Manahilov founded MR Power Ltd, an investor and operator of hydro and solar projects in Central Eastern Europe

From 2004 to 2011, George was a Managing Director and Global Head of Commodities Structured Transactions at Barclays Capital where he managed a team of 11 professionals in New York, London and Singapore and executed $8 billion of structured and principal transactions in power, carbon, oil & gas, refining

Before Barclays, from 2000 to 2004, George was a Vice President at Goldman Sachs (New York) where he helped build a structured financing platform within the Commodities group

George started his career in Energy Investment Banking at JPMorgan Chase in New York

Prior to Walden, Sarah Valdovinos was a Managing Director at Barclays Capital and was Head of Commodities Origination for Latin America, Canada, and U.S. Oil and Gas

Sarah spent 9 years at Barclays, where she managed a team of 12 and was responsible for structuring risk management strategies for governments and corporates in Latin America, US and Canada; she executed over $40 billion notional of commodity derivatives

Prior to Barclays, from 2001 to 2004, Sarah was at Goldman Sachs (New York) as part of the Commodities Latin America team

Sarah started her career in energy at Southern California Edison

Prior to Walden, Henry Weitzner founded Walden Renewables LLC, an investor and operator of renewable energy projects in the U.S. Northeast

From 2001 to 2011 Henry was a Managing Director in Commodities at Barclays Capital, where he built and ran energy trading, managing a team of 30 trading professionals

At Barclays Capital Henry focused on proprietary trading and executing large commodity hedging programs for clients in U.S. Power, Natural Gas, RECs, Emissions, Coal, global LNG and forest products

Before Barclays Capital, Henry spent 8 years at JPMorgan where he was head of the Foreign Exchange and Metals Options trading desk in New York

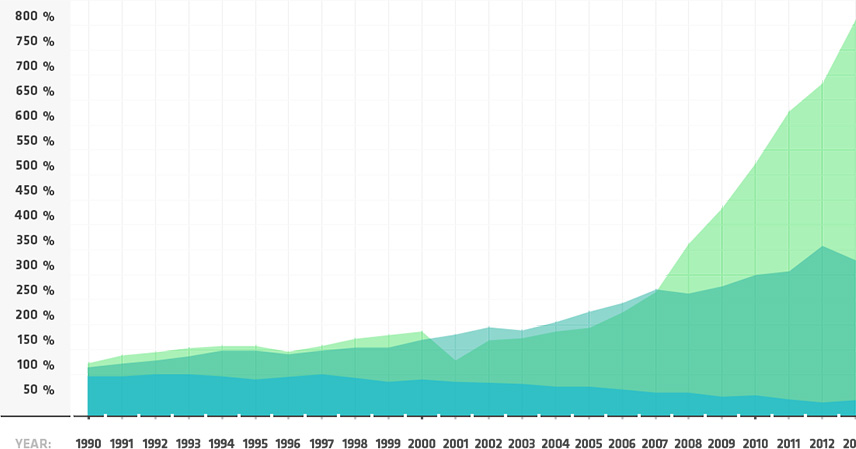

Renewable energy as an asset class offers investors attractive returns and strong long-term projected growth

Renewables are now cost-competitive with traditional fossil fuels, driving their growth in the global energy mix

U.S. Electricity Net Generation:

Excluding generation from wood, conventional hydroelectric, and hydroelectric pumped storage

Walden announced an equity investment by RWE Supply & Trading. RWE’s investment will facilitate the expansion of Walden’s renewable energy project portfolio

03/16/2015info@waldengreenenergy.com

+1 (646) 527-7288

40 Worth Street, 10th Floor

New York, NY 10013